Pkf Advisory Services for Dummies

Some Known Details About Pkf Advisory Services

Table of ContentsGet This Report on Pkf Advisory ServicesPkf Advisory Services Things To Know Before You Buy8 Easy Facts About Pkf Advisory Services DescribedThe Definitive Guide to Pkf Advisory ServicesGet This Report on Pkf Advisory Services

Knowing that you have a solid monetary strategy in place and professional advice to turn to can decrease stress and anxiety and boost the lifestyle for numerous. Broadening access to economic suggestions can additionally play a vital duty in minimizing riches inequality at a social degree. Frequently, those with lower revenues would certainly profit the most from monetary support, yet they are also the least most likely to afford it or understand where to seek it out.Traditional financial recommendations designs usually served wealthier people face-to-face. Models of monetary recommendations are now normally hybrid, and some are also digital-first.

The Main Principles Of Pkf Advisory Services

There is now an advancing breadth of guidance models with a variety of pricing structures to fit a gradient of customer requirements. Another substantial barrier is a lack of trust in economic advisors and the suggestions they supply. In Europe, 62% of the grown-up populace is not certain that the investment suggestions they receive from their bank, insurance provider, or monetary adviser is in their ideal interest.

The future described below is one where economic wellness is within reach for all. It is a future where economic advice is not a luxury yet a necessary service accessible to everybody. The benefits of such a future are far-reaching, however we have a long method to visit reach this vision.

Along with the usually hard psychological ups and downs of divorce, both partners will have to deal with important economic factors to consider. You may extremely well require to transform your financial technique to keep your objectives on track, Lawrence claims (PKF Advisory Services).

A sudden increase of cash or possessions raises immediate inquiries concerning what to do with it. "A financial consultant can assist you assume through the methods you could place that money to function towards your individual and financial goals," Lawrence states. click here for more info You'll wish to consider exactly how much might go to paying down existing financial obligation and just how much you might take into consideration investing to go after an extra protected future.

The 7-Second Trick For Pkf Advisory Services

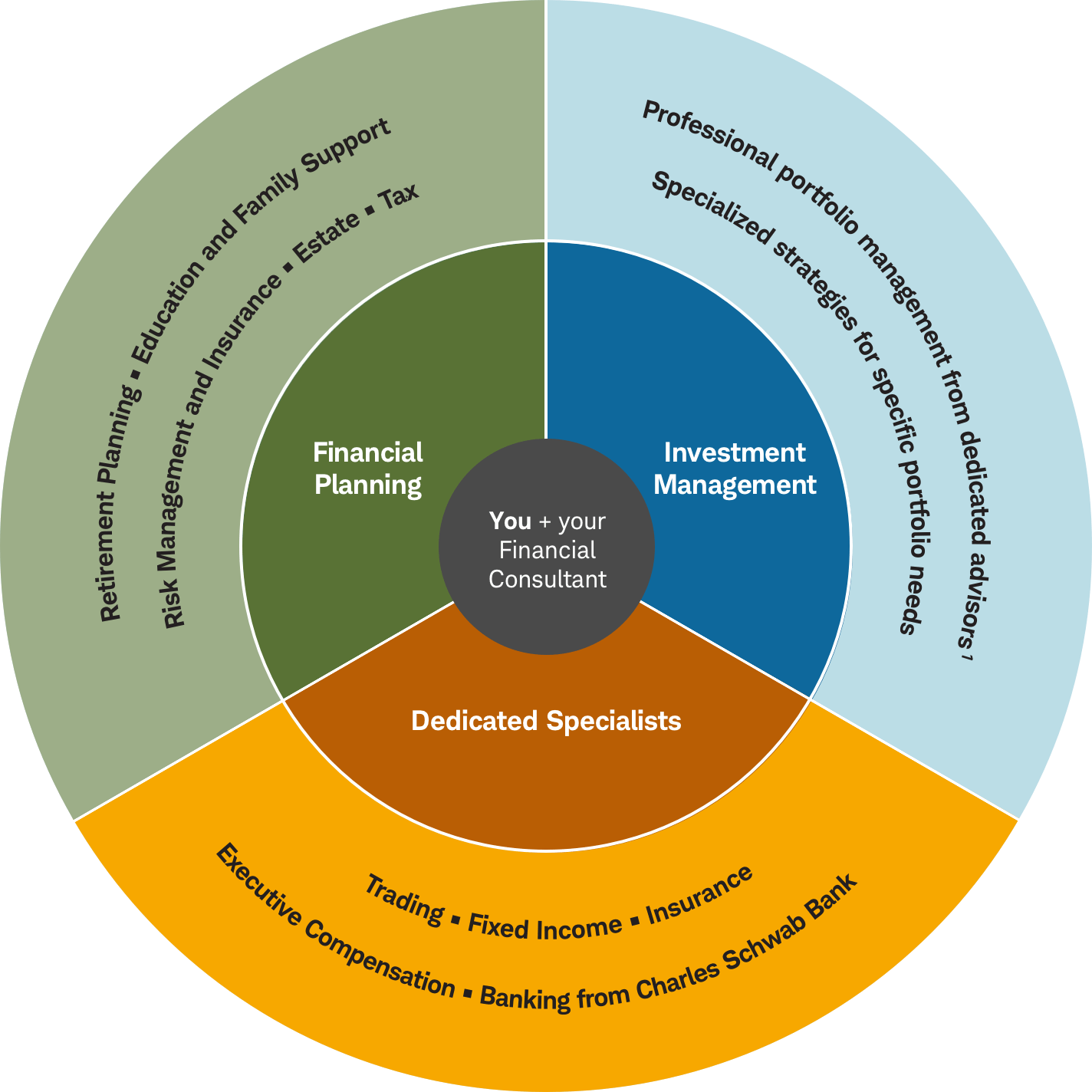

No two people will certainly have rather the same collection of investment strategies or services. Depending upon your objectives along with your resistance for risk and the moment you have to seek those objectives, your expert can aid you determine a mix of investments that are appropriate for you and designed to aid you reach them.

A crucial advantage of developing a plan is having a thorough view of your financial situation. When life adjustments and you struck a bump on your financial roadmap, it's simple to get off track.

Pkf Advisory Services Things To Know Before You Buy

Will I have sufficient conserved for retirement? How will I pay for to send hop over to here my kids to college? Will I ever before have sufficient money to take a trip the world? As soon as the question sets in, the questions begin to expand. A detailed, written strategy provides you a clear picture and instructions for means to reach your objectives.

It is consequently not unusual that amongst the participants in our 2023 T. Rowe Cost Retired Life Cost Savings and Spending Research, 64% of baby boomers reported modest to high degrees of anxiety about their retired get more life savings. When planning for retirement, individuals might benefit from instructional sources and digital experiences to assist them compose an official plan that lays out expected expenses, earnings, and property management techniques.

Developing a formal written plan for retirement has actually revealed some critical benefits for preretirees, consisting of enhancing their confidence and enjoyment concerning retired life. Most of our preretiree survey respondents were either in the procedure of developing a retirement or believing regarding it. For preretirees who were within five years of retirement and for senior citizens in the five years after their retirement date, information showed a purposeful rise in official retirement planning, including looking for assistance from an economic expert (Fig.

The 9-Minute Rule for Pkf Advisory Services

(Fig. 1) Resource: T. Rowe Cost Retirement Cost Savings and Spending Study, 2023. Numbers may not complete 100% due to rounding. Preretirees may locate worth in a series of services that will certainly assist them prepare for retired life. These can consist of specialized education to aid with the withdrawal and earnings stage or with essential choices such as when to collect Social Protection.